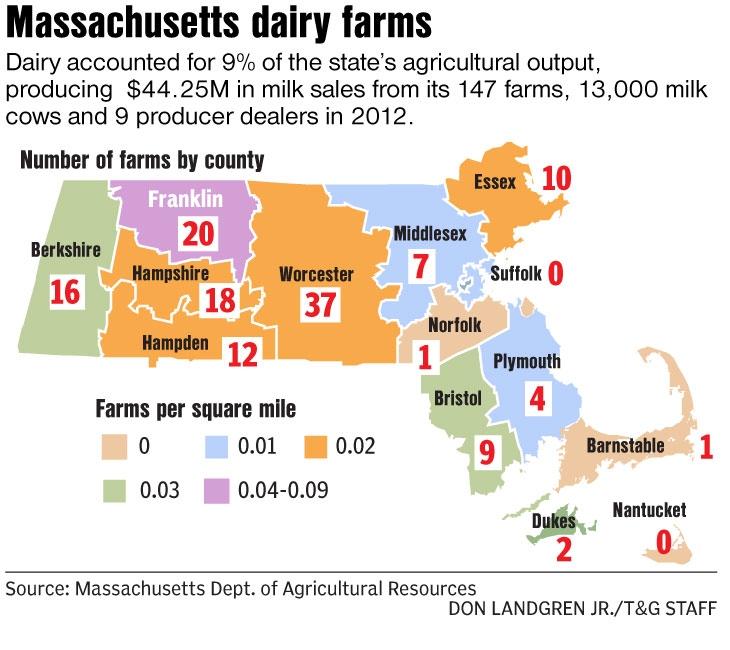

Mass. Dairy Farmers Urge State to Keep Tax Credit

According to a WOW report at telegram.com Mass. dairy farmers urge state to keep tax credit.

“Dairy farmers voiced support for making the emergency dairy tax credit program a permanent part of the tax code.

At a state Department of Agricultural Resources hearing, Mark Duffy, a Carlisle dairy farmer, and David Hanson, owner of Hanson Farm in North Brookfield, said the importance of the program could not be understated for the future of the state’s dairy industry.

At a state Department of Agricultural Resources hearing, Mark Duffy, a Carlisle dairy farmer, and David Hanson, owner of Hanson Farm in North Brookfield, said the importance of the program could not be understated for the future of the state’s dairy industry.

“The next generation of dairy farmers coming along is looking at the dairy industry as a whole. It’s not just about milking cows, but whether this is a viable model for supporting a farm and providing for a family,” Mr. Duffy said.

Mr. Duffy, a Cabot Creamery Cooperative director, said he was speaking on behalf of Massachusetts farmers in the Agri-Mark dairy cooperative, and the Massachusetts Association of Dairy Farmers.

The program, instituted in 2008 as a component of the Dairy Farm Preservation Act, allows the state’s dairy farmers a refundable income tax credit based on the amount of milk produced and sold at the Federal Milk Marketing Order price for the Northeast market.”

Read the full story at Telegram.com